how much does the uk raise in taxes

Increase 45 additional rate of Income Tax by 1p. How much does the UK raise in tax compared to other countries.

Types Of Tax In Uk Economics Help

In line with inflation there will be an increase in allowances and the basic rate limit.

. MPs poised to investigate alleged Abba Party in No10 flat after Sue Gray failed to 26 May 2022. One of the most famous examples of a windfall tax in the UK was one announced by then-chancellor Gordon Brown in 1997 when the privatised utilities were hit for around 5bn. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

The UK has one of the more progressive. Income Tax Capital Gains Tax National Insurance Contributions. The UK is more of an outlier at the median especially for SSCs than it is for top earners.

For 202122 the personal allowance will be 12570. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax. It would need to impose a permanent annual increase in taxes or cut in spending equal to 43 per cent of GDP 84bn in todays money in 2022-23.

From 168 billion in 202122 to 6 billion in 202223. Rishi Sunaks energy tax explained and how much it will raise. From 229 in total income taxes it is anticipated that receipts will increase.

Chancellor Rishi Sunak has presented two Budgets already and faces introducing UK tax rises to pay for unprecedented levels of public spending. In the first year of the pandemic from April 2020 to 2021 it borrowed 299bn the highest figure. The Energy Profits Levy is an additional 25 per cent tax on UK oil and gas profits on top of the existing 40 per cent.

For example income tax is. One of the EU15 countries that raise more tax than the UK. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate.

How cost-of-living plan will impact your money from 650 payment to energy. A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century. Receipts for April 2021 to March 2022 are 3958 billion which is 474 billion higher than in the same period a year.

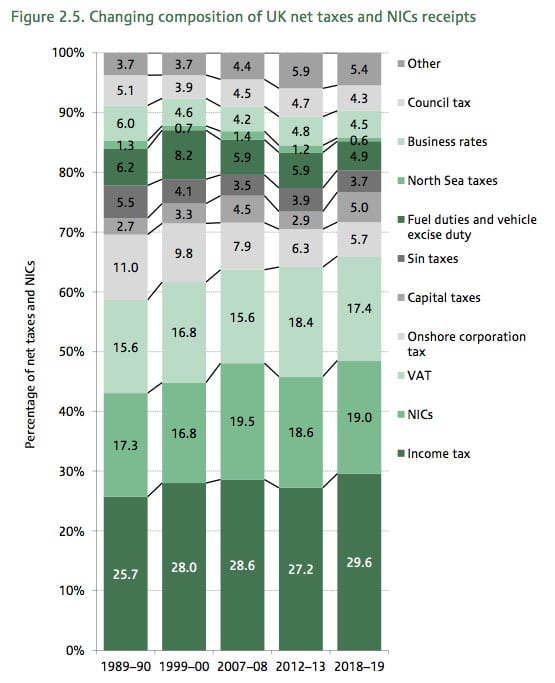

But this relative stability masks important changes in the composition of revenues. UK tax revenues were equivalent to 33 of GDP in 2019. Alternatively the government could achieve.

Johnson had promised to. For the 202223 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also. Increasing Income Tax for only the highest rate taxpayers would raise an estimated additional 60 million next year if.

The government has the potential to raise up to 174bn a year to help cope with the Covid-19 crisis if it taxed wealth at the same rate as income a UK tax expert has said. This has meant the government has had to borrow huge sums of money. The three tax rates are set to remain the same for 2020.

Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in. This was true in 2010 and is forecast to be true in five years time.

Pin On Making Money Online The Right Way For Anyone

Types Of Taxes Board Game Teks 5 10a Types Of Taxes Online School Online Programs

Britain We Need To Raise Your Taxes Ifunny Stupid Funny Stupid Memes Really Funny

U S Alcohol Tax Revenue 2027 Statista

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 5 D Online Taxes Income Tax Filing Taxes

Government Revenue Taxes Are The Price We Pay For Government

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

My Kingdom Is No Part Of This World Is It Lawful To Pay Head Tax To Caesar Or Not Matt 22 17 The Party Follower Jesus Quotes Daily Scripture Paying Taxes

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Gst Suvidha Kendra Kendra Gst Filing Taxes Money Transfer How To Apply

Government Revenue Taxes Are The Price We Pay For Government

Types Of Tax In Uk Economics Help

Uk Government Revenue Sources 2022 Statista

Government Revenue Taxes Are The Price We Pay For Government

And While You Re At It Give Them A Proper Lesson In Taxation Taxes Humor Accounting Humor Funny Quotes

Richard Burgon Mp On Twitter Richard Investing Twitter

Government Revenue Taxes Are The Price We Pay For Government