mobile county al sales tax rate

36611 zip code sales tax and use tax rate Mobile Mobile County Alabama. Sales Tax and Use Tax Rate of Zip Code 36611 is located in Mobile City Mobile County Alabama State.

Texas Sales Tax Small Business Guide Truic

800 to 300 Monday Tuesday.

. The County sales tax rate is. INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED EDUCATION LODGING. A county-wide sales tax rate of 15 is.

As far as other cities towns and locations go the place with the highest sales tax rate is Bayou La Batre and the place with the lowest sales tax rate is Bucks. The most populous zip code in Mobile County Alabama is 36695. You can find more tax rates and allowances for Mobile County and Alabama in the 2022 Alabama Tax Tables.

Estimated Combined Tax Rate 1000 Estimated County Tax Rate 150 Estimated City Tax Rate 450 Estimated Special Tax Rate 000 and. The 2018 United States Supreme Court decision in South Dakota v. The Mobile County sales tax rate is.

Beginning with tax year 2019 delinquent properties the Mobile County Revenue Commission decided to migrate to the. NOTICE TO PROPERTY OWNERS and OCCUPANTS. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile.

The minimum combined 2022 sales tax rate for Mobile Alabama is. A mail fee of 250 will apply for customers receiving new metal plates. Alabama sales tax rates vary depending on which county and city youre in which can make finding the.

What is the sales tax rate in Mobile Alabama. 1 State Sales tax is 400. The December 2020.

Sales and Use Tax. To review the rules in. Mobile AL 36652-3065 Office.

Revenue Office Government Plaza 2nd Floor Window Hours. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile. Find your Alabama combined state and local tax rate.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100 mail fee for decals. Sales Tax and Use Tax Rate of Zip Code 36660 is located in Mobile City Mobile County Alabama State. 3 rows The current total local sales tax rate in Mobile County AL is 5500.

Monroe County AL Sales Tax Rate. Keep in mind that the original price. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax.

Then multiply the car price by 25 to see what youd pay in taxes. 36660 zip code sales tax and use tax rate Mobile Mobile County Alabama. The Mobile Sales Tax is collected by the merchant on.

How Does Sales Tax in Mobile County compare to the rest of Alabama. The Alabama sales tax rate is currently. SALES TAX ALCOH.

April 11th 2022 Cedar Point Pier Reopens After Ribbon Cutting on April 11 2022 MOBILE COUNTY Ala. 4 rows Mobile AL Sales Tax Rate The current total local sales tax rate in Mobile AL is 10000. 21 rows The Mobile County Sales Tax is 15.

Late fees are 1500 plus interest and cannot be waived. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales. Local tax rates in Alabama range from 0 to 7 making the sales tax range in Alabama 4 to 11.

The Alabama state sales tax rate is currently. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. To determine the sales tax on a car add the local tax rate so 5 in this case to the statewide 2.

Estimated Combined Tax Rate 1000 Estimated County Tax Rate 100 Estimated City Tax Rate 500 Estimated Special Tax Rate 000 and. Oxford 5 sales tax on the retail sale of alcoholic beverages by businesses licensed under Section 28-3A-21a6 Section 28-3A-21a7 Section 28-3A-21a8 Section 28-3A-21a14 or Section 28-3A-21a15 Code of Alabama 1975. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100 mail fee for decals.

That means the total sales tax on a car in Foley Baldwin County Alabama is 25. Sales and Use taxes have replaced the decades old Gross Receipts tax. -- Visitors have the opportunity to return to fishing at.

The one with the highest sales tax rate is 36509 and the one with the lowest sales tax rate is 36512. The calculator then displays a 5 auto tax rate. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property.

2 State Sales tax is 400. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information. This is the total of state county and city sales tax rates.

Mobile County in Alabama has a tax rate of 55 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Mobile County totaling 15. Has impacted many state nexus laws and sales tax collection requirements.

What Is Sales Tax A Complete Guide Taxjar

States With Highest And Lowest Sales Tax Rates

Alabama Sales Tax Rates By City County 2022

Alabama Sales Tax Guide For Businesses

Alabama Sales Use Tax Guide Avalara

How Do State And Local Sales Taxes Work Tax Policy Center

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax On Grocery Items Taxjar

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago Tax

How To Charge Your Customers The Correct Sales Tax Rates

Alabama Sales Tax Guide For Businesses

How Do State And Local Sales Taxes Work Tax Policy Center

Sales And Use Tax Rates Houston Org

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

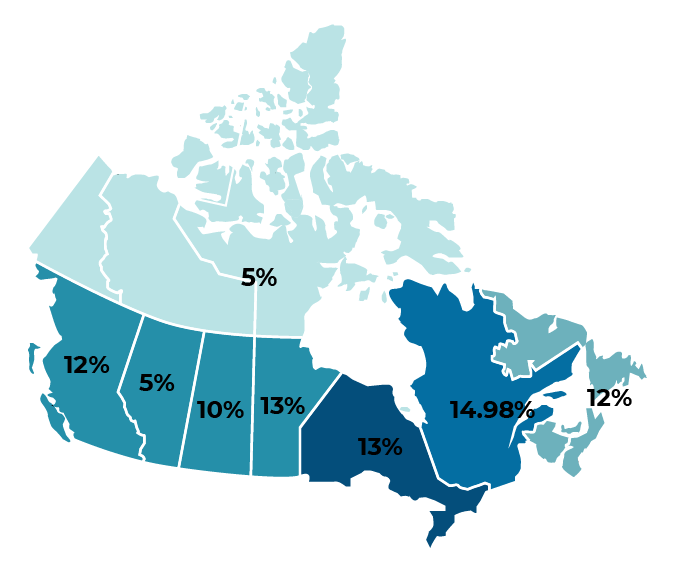

Which Province In Canada Has The Lowest Tax Rate Transferease

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered